Fintech market in Uzbekistan

This study will familiarize you with the fast-growing financial technology market of Uzbekistan, its development history, state of affairs and perspectives

© 2023, by Mastercard

------------ Uzbekistani Fintech

Market Study

• content overview

Unlocking financial frontiers: a glimpse into Uzbekistan's thriving fintech ecosystem

Infrastructure and growth factors

▸Economy in figures

▸Digital infrastructure

▸Banking industry

Fintech ecosystem

▸Ecosystem map

▸Access to capital

▸Government support and IT Talents

Major fintech trends

▸Digital wallets

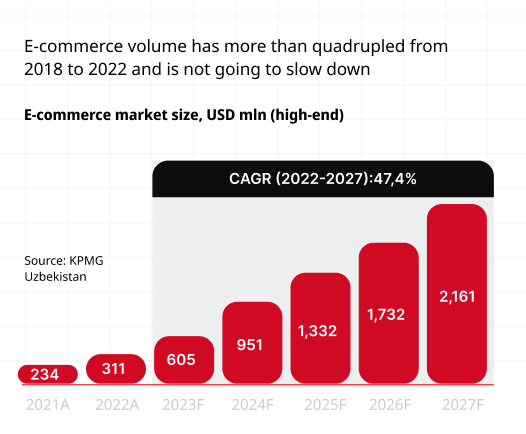

▸E-commerce

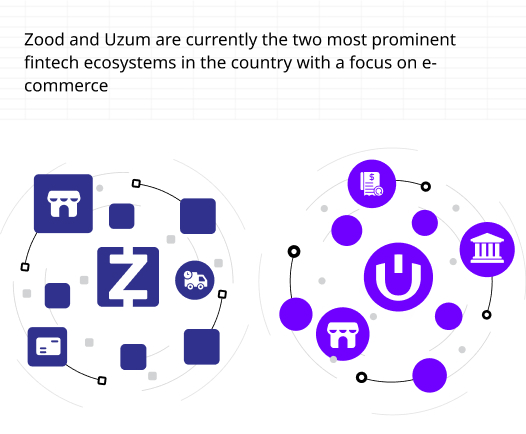

▸Superapps

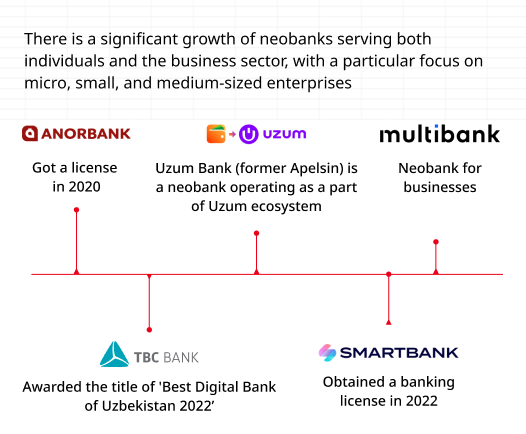

▸Neobanks

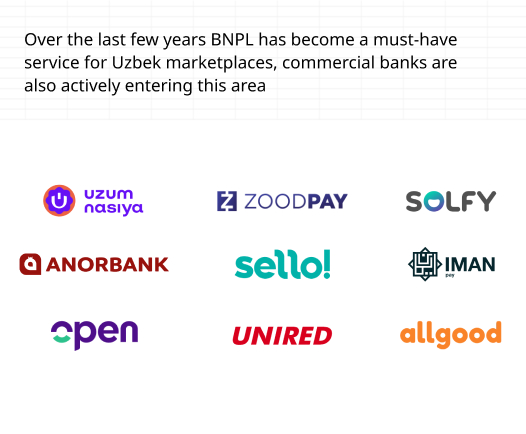

▸Buy Now, Pay Later

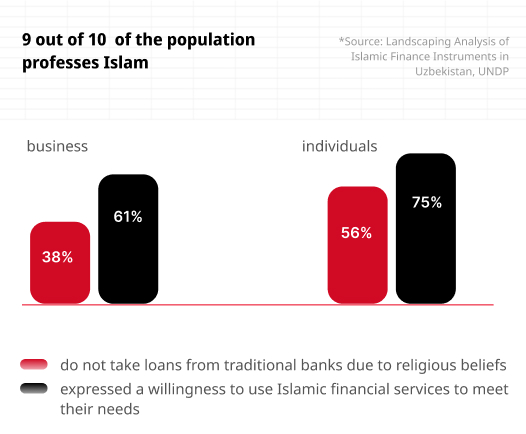

▸Islamic fintech

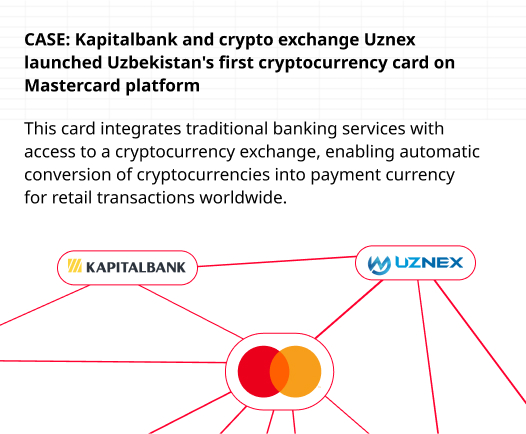

▸Crypto

Rising fintechstars

▸Zood

▸Billz

▸Iman

▸Marta

▸Sug'urta Bozor

Lesson learned and perspectives

▸Market opportunities

▸Restraints

▸Perspectives and future trends

• Get access •

The research results

• Market in numbers

The fintech landscape in Uzbekistan - key statistics and drivers of growth (as of 31 December 2022)

77

%

Internet penetration

76

%

Smartphone penetration

35

banks*

The 5 largest state-owned commercial banks account for 62% of total sector assets

49

Payment organizations that have obtained a license*

70

+

Fintechs

61

%

Venture funds in last 2 years was allocated to fintechs*

2.2

%

E-commerce market penetration (as a % of retail)

10

Licensed crypto-stores*

2

Crypto-exchanges*

*As of 15 November 2023

4 market opportunities

Young, fast-growing, and urbanizing population

Uzbekistan is one of the fastest growing population in Central Asia. As of July 1, 2023, population stands at 36.4 mln, surpassing UN DESA predictions of 35.1 mln. The country's relatively young population, with a median age of 29, presents opportunities for the fintech sector

Push for financial inclusion

The government is actively addressing financial inclusion, while also fostering an enabling fintech ecosystem

Increases in spending and GDP growth

In 2022, urbanization, lifestyle changes, increased purchasing power and a thriving economy drove growth in the fintech market. Further fintech development expected due to rising prosperity and reduced inequality

White spaces are emerging across the market

Past uneven access to banking services, particularly for various population segments and SMEs, has created growth opportunities. While fintechs have made progress in digital wallets and payments, there's still room for expansion as the market matures

• market players •

Fintech ecosystem map

Mobile Banks

Payments and Transfers

BNPL Services

Electronic Money Issuers

Processing Сenters and Payment Systems

Internet acquiring

Blockchain Initiatives

Digital Insurance

POS

Scoring

Investments

Financial Marketplace

SME Accounting and Finance Management

Associations and Unions

Technology Parks

Venture Capital

Public Authorities

International Organizations

Incubators and Accelerators

Education

Mobile Banks

Payments and Transfers

BNPL Services

Electronic Money Issuers

Processing Сenters and Payment Systems

Internet acquiring

Blockchain Initiatives

Digital Insurance

POS

Scoring

Investments

Financial Marketplace

SME Accounting and Finance Management

Associations and Unions

Technology Parks

Venture Capital

Public Authorities

International Organizations

Incubators and Accelerators

Education

• Venture capital

From 2022 to 2023, $7.1 mln was invested in 25 companies across industries, with over 61% of these funds allocated to fintech companies

• High potential segments •

Major fintech trends

• Challengers •

Rising Fintechstarts

E-commerce & lending

It is an ecosystem that combines an e-commerce lending platform (ZoodPay), a marketplace (ZoodMall), delivery and logistics services (ZoodShip), and a digital bank

Mobile acquiring

A fintech startup that provides mobile acquiring services for small businesses. The company offers a mobile terminal with which you can connect to a smartphone and accept payments from cards of various payment systems

SaaS for retail

Provides all-in-one store management automatization solutions for companies in retail business. The company offers 3 types of monthly and yearly subscriptions with a variety of services for retail companies, in addition it began providing financing and development of an online store for its customers

BNPL & investments

The company has two divisions, which are IMAN Invest and IMAN Pay. IMAN Invest provides Mudarabah investment account for its users via a mobile application. IMAN Pay is a Sharia-compliant financing solution that provides installment plans for purchasing consumer goods (buy now pay later)

Insurance marketplace

The first insurance marketplace that consolidates insurance packages from insurance companies in Uzbekistan and provides the most relevant insurance policy based on the inputs made by the user. The startup has introduced a monthly car insurance subscriptions. Car insurance policies can be purchased without the inspection of the vehicle